By Carlotta Zaccarella

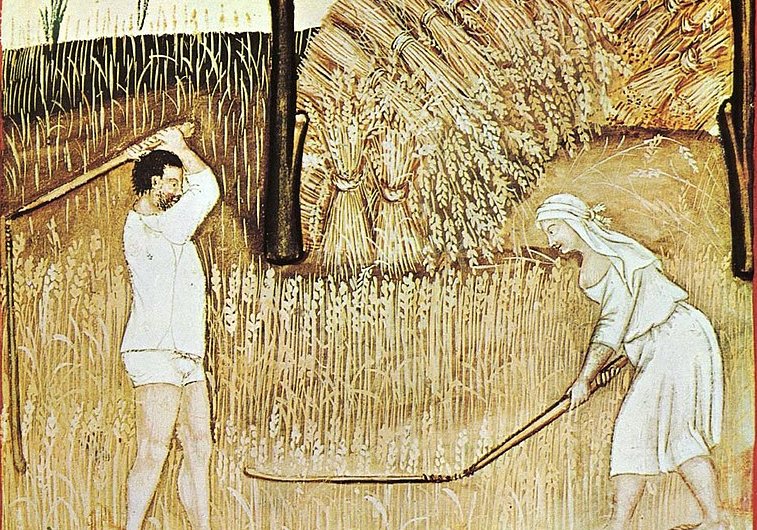

The consequences of the conflict and the repercussions on one of the most popular foods: wheat. Ukraine is the fifth largest exporter of wheat in the world, and the Russian Federation holds the global record. Together, they produce a third of the wheat that moves around the world for commercial (and humanitarian) reasons. The first instalment of this analysis, on their roles and current difficulties, can be read here.

The consequences of this war

The main consequence of this bleak picture is the loss of most of Ukraine’s grain: this will have a staggering impact in the short, medium and long term.

Firstly, this loss translates into an increase in the price of grain. Even before the conflict, a rise in the price of grain had been registered, due to bad harvests. In 2021, in fact, the climate crisis caused abnormal waves of drought that affected the fields of other major world producers, such as Argentina, Canada and the United States, just when the grain was sown or ripening. Subsequently, its prices on agricultural markets had risen due to the increased cost of energy, transport and packaging.

Before the invasion of Ukraine, soft wheat (used for bread and cakes) was about 40% more expensive than the previous year. In February, the FAO Cereal Price Index recorded a general rise in the prices of all cereals. For wheat, the reason was the turmoil in the Black Sea region, with Russia and Ukraine at the centre. As the war exploded, so did the price of this essential commodity for many. Market operators report that the last two months have seen a rise in the price of this essential commodity from 35-40 cents per kilo to 65-80 cents fro the same amount: an overall doubling.

Countries are preparing to deal with this further crisis according to their capacities. Most are turning to other grain producers, to see how to access their goods and how to find resources to pay for the often higher costs of transporting and storing the grain. The tension of this search is heightened by the instability that the conflict brings throughout the Black Sea and surrounding waters, from where cargo ships carrying grain from other countries (e.g. Kazakhstan) pass. They are also trying to figure out what to do about domestic production. The EU agriculture ministers, for example, have discussed the possibility of increasing production by allowing farmers to cultivate the 10% of the land that is usually left uncultivated.

Upcoming rationing, upcoming turmoil

But it is not Europe that is primarily affected by the blockage of Ukrainian cereal production. The countries of the Middle East and North Africa are suffering the most, as their grain stocks are almost entirely made up of grain from Kyiv (and from Moscow).

Ukraine is also one of the largest suppliers to countries such as Pakistan, Bangladesh, Somalia, Syria, Libya and Lebanon. About 60% of Beirut’s reserves come from the Ukrainian countryside. At the end of February, the Minister of Economy and Trade declared that the country still had stocks for a month or a month and a half. Tunisia is in a similar situation, as almost 80% of its reserves come from the two countries in conflict. The same applies to Yemen (more than 30%), Turkey (70% of stocks) and Egypt, the world’s largest importer of wheat. Cairo buys two-thirds of its stocks from Ukraine and Russia: the authorities said they had stocks until mid-June. Then, the situation is unclear because domestic production (which should be ready in April) has never been sufficient to cover national needs.

This is the case for all countries in an already highly unstable region where the population’s diet is heavily dependent on wheat processing. It is estimated that about half the calories of an average family in Yemen come from bread. And bread is a commodity subject to state subsidies in many of these economies, such as Egypt and Lebanon. Authorities have already indicated that they will be forced to ration or increase the cost of wheat products, without specifying if and how the price of bread will continue to be capped.

The caution is due to the fear that the news of an increase in a product so important to the population may cause their anger to flare up. Many of the nominated Middle Eastern and North African states are experiencing extreme tension. Turkey is experiencing its worst inflation in twenty years. Lebanon is running out of cash. Tunisia is in an economic depression that is already agitating the population. Syria and Yemen have been living in a state of endemic war for more than a decade.

The war in Ukraine threatens to block the humanitarian food aid system that could provide relief to these countries. The World Food Programme (WFP) estimated that in 2021, 70% of the 1.4 million tonnes of wheat it bought for distribution to the neediest countries came from Ukraine and Russia. The difficulties of supply are compounded by the rising cost of the commodity. Due to shortages, war, the economic consequences of the Covid-19 pandemic and rising oil prices, WFP is paying about 30% more for its stocks than it did at this time in 2019. That means about 50 million more per month.

The Programme itself states that 44 million people are living in famine in the world. The conflict in Ukraine threatens to push many more into the abyss. For Yemen, for example, a continuation of the present situation would be a catastrophe. Arif Husain, WFP’s chief economist, therefore described the war as ‘an unnecessary shock of enormous proportions’.

The UN’s International Fund for Agricultural Development has also expressed its concern about the European picture: the consequences of a prolonged conflict, and specifically the scarcity of basic necessities such as grain, would result in spiralling prices. And therefore hunger.

The measures taken by some countries, producers and consumers, complicate the situation. And they feed the circuit of upward speculation. Hungary, Bulgaria and Moldova have halted cereal exports, while China has already begun a race to the hoard. The eastern giant has been stockpiling for months and has signed an agreement with Russia to reopen its market to Moscow’s wheat. Imports from the Federation had been blocked for food safety reasons. However, Beijing has now indicated that it is willing to resume trade and support the Russian economy in this way too. Especially if the sanctions imposed because of the invasion of Ukraine should choke it. The Ukrainian government, for its part, has banned the export of wheat to cope with the national emergency.

Against this background, it is obvious that the region that exports 12% of the world’s calories needs to be pacified, according to the International Food Policy Research Institute. The consequences of the ongoing war are immense, not least from the point of view of international food security and health. Near and far from Kiev. We need to remember that the so-called Arab Spring broke out because the serious economic crisis that people were experiencing was accompanied by food insecurity: the people could not buy any bread. In Tunisia people are already queuing up to buy it, amid protests and concerns about prices. In Syria, wheat has already begun to be rationed.

The time to act is running out.

Read the first half of this analysis by clicking here.