More and more energy is being consumed, the costs of raw materials are rising, and so are the investments of the large oil and gas industries. This dossier takes stock of how much energy is consumed in the world, which countries will benefit most from rising prices and which companies are planning to invest the most in new fields.

Expenses and investments that often do not fit in with Goal 7 of the 2030 Agenda For Sustainable Development (the action programme signed in September 2015 by the governments of the 193 UN member countries) which aims to “Ensure access for all to affordable, reliable, sustainable and modern energy systems” and Goal 13 aimed at “promoting action at all levels to combat climate change”.

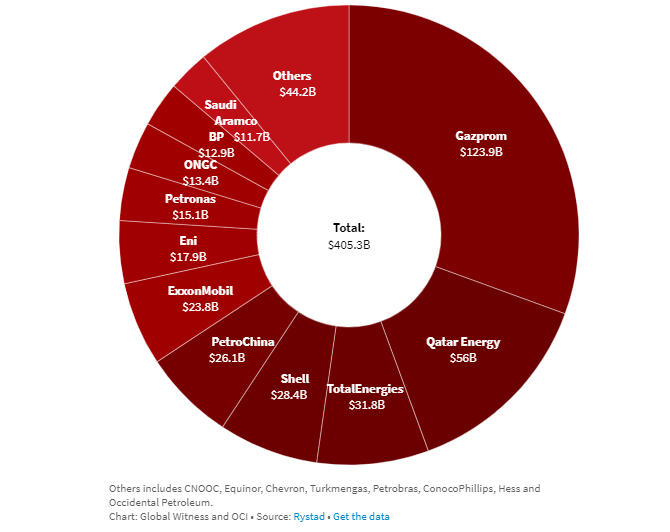

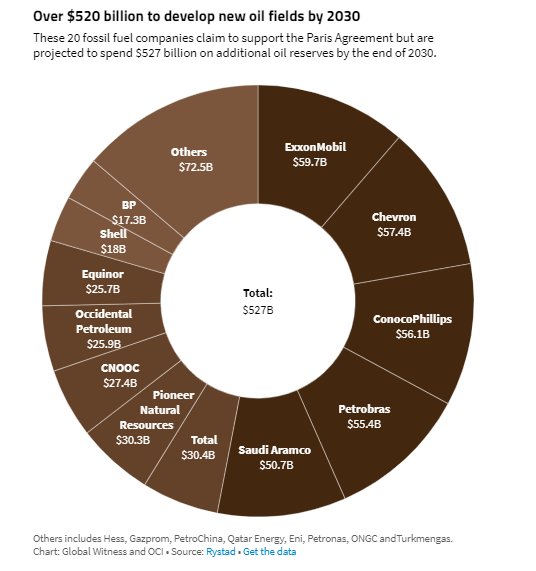

*Cover Photo by Marc-Olivier Jodoin on Unsplash. Below are two graphs from research by Global Witness and Oil Change International using Rystad Energy data.

A sea of investments in Oil and Gas

Twenty of the world’s largest oil and gas companies will spend $932bn by the end of 2030 to develop new oil and gas fields and, by the end of 2040, this figure will grow to $1.5trillion. This was revealed in a new analysis by Global Witness and Oil Change International using data from Rystad Energy, an independent energy research company.

In April 2022, the Intergovernmental Panel on Climate Change (IPCC) reiterated that the use of “far fewer fossil fuels than today” is “essential” if the world is to have any chance of keeping global warming below the critical 1.5°C threshold, as enshrined in the Paris Agreement. Antonio Guterres, secretary-general of the United Nations, also described new investments in fossil fuel infrastructure as “moral and economic folly”. “Governments and high-yield corporations,” he said, “are not just turning a blind eye; they are adding fuel to the fire. They are smothering our Planet, based on their vested interests and historical investments in fossil fuels, when cheaper renewable solutions provide green jobs, energy security and greater price stability”.

Grabbing new deposits

Russian company Gazprom will be the one to spend the most on new gas fields ($124bn, almost a third of planned investments in new fossil gas by 2030), followed by Qatar Energy ($56bn) and Total Energies ($32bn).

Shell is in fourth place for gas investments of $28bn. And it’s three other US companies that will top the list for new oil extraction: Exxon ($59bn), Chevron ($57bn) and Conoco Phillips ($56bn). More than $173bn will be invested in the development and discovery of new oil fields by the end of 2030.

WHO DOES WHAT: the highest-earning companies

Continued high commodity prices and increased oil and gas supplies will push payments to energy-exporting countries to an all-time high of 2.5trillion in 2022, beating the previous record of 2.1trillion set in 2011.

Saudi Arabia will be the largest recipient in absolute terms. It is expected to receive just over $400bn from its oil industry this year, an increase of almost $250bn from 2021. The US, including royalties paid to private landowners, ranks second with about $250bn in earnings, up $100bn from 2021. Iraq follows with about 200bn in total tax revenues, double the previous year’s figure. Norway ranks fourth despite being only the world’s tenth largest oil and gas producer: the government will receive around $150bn in total tax revenues.

FOCUS 1: Expenditures on the rise

Continued high commodity prices and increased oil and gas supplies will push payments to energy-exporting countries to an all-time high of 2.5trillion in 2022, beating the previous record of 2.1trillion set in 2011.

Saudi Arabia will be the largest recipient in absolute terms. It is expected to receive just over $400bn from its oil industry this year, an increase of almost $250bn from 2021. The US, including royalties paid to private landowners, ranks second with about $250bn in earnings, up $100bn from 2021. Iraq follows with about 200bn in total tax revenues, double the previous year’s figure. Norway ranks fourth despite being only the world’s tenth largest oil and gas producer: the government will receive around $150bn in total tax revenues.

FOCUS 2: The increasing need for energy

Compared to 2020, the costs of oil and gas projects have increased by between 10% and 20%. This is mainly due to higher steel prices and a tighter supplier market. In the same period, in the renewable energy sector, lithium, nickel, copper and polysilicon, (important materials in battery production and solar photovoltaics) increased renewable project costs between 10% and 35%.

“The world is spending more energy than ever before,” said Audun Martinsen, Head of Energy Service Research at Rystad Energy, “2014 was the last time we recorded similar numbers. We can see a major change in the amount of spending on green energy, which has increased, with a decline in spending on oil and gas. However, spending on other fossil fuels, such as coal, has remained constant.